Starting a trucking business requires specialized insurance focusing on liability, cargo protection, and physical damage. Partnering with insurers catering to small trucking operations offers tailored, affordable policies, protecting investments and enabling growth. Key coverage areas include comprehensive liability, cargo, and physical damage insurance, plus business interruption and legal expenses. Thorough research is crucial when selecting an insurer, choosing a provider specializing in trucking coverage for new businesses.

Starting a trucking business can be a challenging yet rewarding endeavor. For new trucking startups, understanding and securing the right coverage is paramount to navigate risks and ensure smooth operations. This article explores the benefits of partnering with insurers specializing in small trucking operations. We’ll delve into the unique needs of these startups, key coverage areas like liability and cargo insurance, and provide tips on finding and choosing the best insurance provider for affordable startup protection.

Understanding the Unique Needs of Trucking Startups

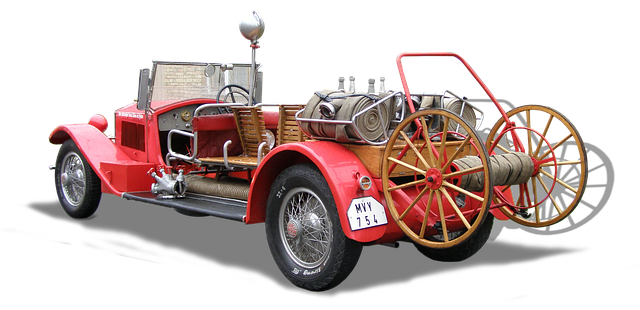

Starting a trucking business can be a complex and challenging endeavor, especially for newcomers to the industry. Trucking startups often face unique risks and have distinct insurance needs that differ from established, larger operations. These new businesses typically operate with smaller fleets, requiring tailored policies that balance affordability with comprehensive coverage. Affordable startup insurance options are crucial to help these companies stay afloat while they establish themselves in the market.

Liability insurance is a cornerstone for any trucking operation, protecting against potential accidents and claims. Cargo insurance is also essential for startups to safeguard their valuable cargo during transportation. Physical damage coverage can mitigate the risk of vehicle-related losses. Insurers specializing in small trucking operations understand these specific needs and offer tailored policies designed to meet them, ensuring that new trucking businesses are well-protected from the outset.

The Benefits of Partnering with Specialized Insurers

Partnering with insurers who specialize in small trucking operations offers a multitude of benefits for new and growing trucking businesses. These experts provide access to tailored trucking policies that go beyond basic coverage, including comprehensive liability insurance startups, physical damage coverage, and specialized cargo insurance for new trucking companies. By working with such insurers, trucking business owners can secure affordable startup insurance that protects their investment and keeps their operations running smoothly.

Specialized insurers understand the unique risks faced by small fleet insurance providers and offer solutions designed to meet these specific needs. This means startup trucking companies can obtain the necessary coverage without breaking the bank, ensuring they’re protected against potential losses and liabilities. This partnership fosters a sense of trust and reliability, enabling new trucking businesses to focus on growth and expansion while leaving their insurance concerns in capable hands.

Key Coverage Areas for Small Fleet Operations

Small trucking operations often face unique challenges when it comes to insurance, which is why partnering with insurers specializing in this sector is a strategic move for startup trucking companies. These experts provide tailored policies that address the specific needs of new trucking businesses. Key coverage areas include liability insurance, which protects against potential claims related to accidents or damage caused during operation; cargo insurance, ensuring the safety and security of goods being transported; and physical damage coverage, safeguarding vehicles from accidents, natural disasters, and other unforeseen events.

Additionally, small fleet operations may benefit from comprehensive policies that offer business interruption coverage, helping to stabilize financial operations during unexpected events. Tailored trucking policies also commonly include specific provisions for mechanical breakdowns, cargo loss or damage, and legal expenses related to disputes. This combination of protections ensures new trucking businesses can navigate the uncertainties of the road with confidence, focusing on growth and success while leaving insurance concerns to specialists who understand the nuances of this industry.

How to Find and Choose the Right Insurance Provider

When searching for an insurer to partner with for your small trucking operation, it’s crucial to conduct thorough research and choose a provider that understands the unique needs of this industry. Start by identifying insurance startups or established companies specializing in trucking coverage. Look for those offering tailored trucking policies that cater specifically to new businesses, as they are more likely to provide affordable startup insurance options.

Consider your specific requirements, such as liability insurance for potential cargo-related incidents and physical damage coverage for your fleet vehicles. Compare the policies on offer, focusing on comprehensive protection while also keeping costs in check. Remember, the right insurer will not only provide adequate coverage but also offer a seamless claims process should any unforeseen events occur during your trucking operations.

For aspiring trucking entrepreneurs, navigating the complex landscape of insurance can be a daunting task. However, by partnering with insurers specializing in small trucking operations, startups can gain access to tailored policies that address their unique needs. These specialized providers offer comprehensive coverage, including liability insurance for potential risks and physical damage protection for fleet assets, all while providing affordable startup insurance solutions. By choosing the right insurance provider, new trucking businesses can ensure they’re prepared to hit the road with confidence, focusing on growth rather than worry.